401(k) 101

The term “401(k)” has become nearly synonymous with many types of employer sponsored retirement plans, it is easy to understand why there is confusion among business owners and operators about plan types, contribution limits, qualified compensation limits, and more. The Physicians 401k is a program that capitalizes on the flexibility allowed within these ERISA-governed plans to achieve the greatest benefit to our clients.

WHAT IS ERISA?

The Employee Retirement Income Security Act of 1974 was enacted to protect the assets of Americans held in employer-sponsored plans. It established minimum standards for plan provisions such as eligibility, funding, beneficiary rights, participant education and disclosure, and protection against discrimination. It also establishes those owners and officers who adopt and maintain the plan as fiduciaries who have certain obligations to the employees for whom the plan benefits.

WHAT IS A FIDUCIARY?

Plan fiduciaries are responsible for acting on behalf of and in the best interest of plan participants and their beneficiaries. These include the duty to:

- act prudently as it relates to the process of adopting, implementing, and managing the plan

- diversify plan investments and ensure fees are reasonable

- and understand and abide by the legal plan document

Physicians 401k employs a holistic, consultative approach with a team of specialists in the areas of plan design, administration, legal compliance, and investment advising. This team serves as a fiduciary alongside the plan sponsor and executes necessary functions and coordinates all service providers.

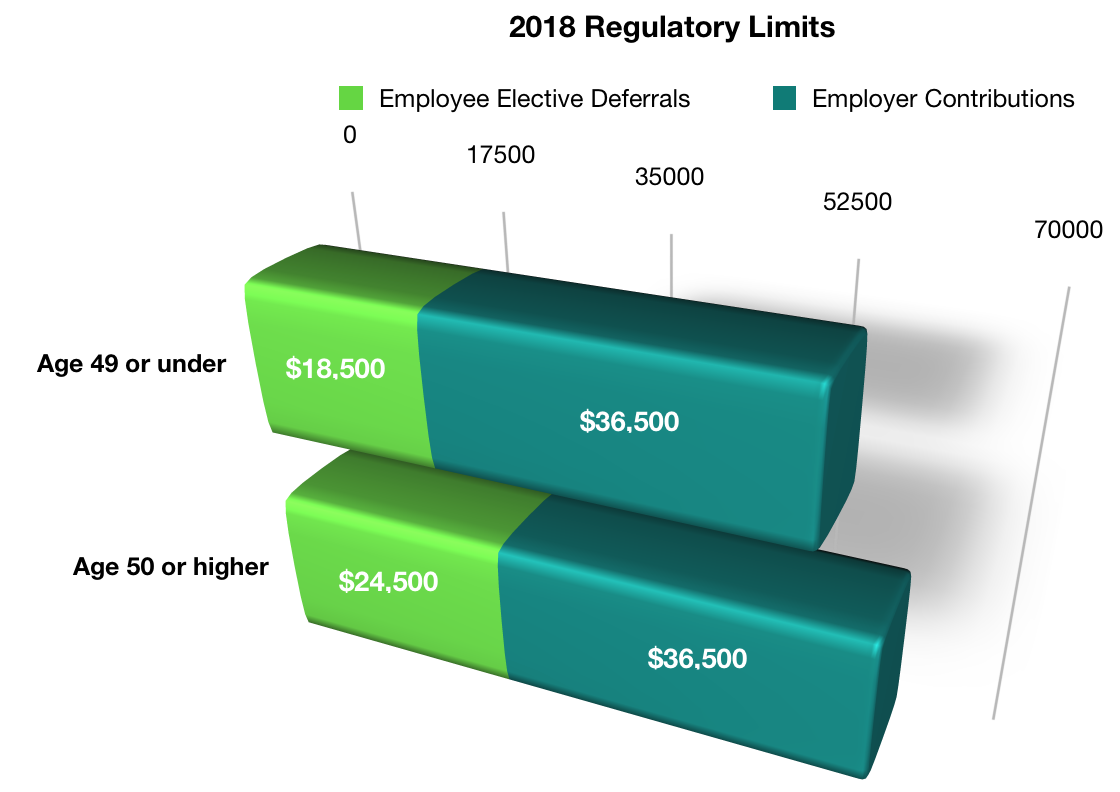

WHAT ARE THE CURRENT REGULATORY LIMITS?

For 2018, the maximum tax deductible contribution to an employer sponsored defined contribution plan is $55,000 (or $61,000 for employees over age 50).

WHAT ELSE MAY LIMIT CONTRIBUTION AMOUNTS?

Plans must perform annual nondiscrimination tests outlined by the IRS to determine the level at which most owners and/or highly compensated employees (HCEs) may make employee deferrals and receive employer matching or profit sharing contributions. These tests are focused on the amount of benefit afforded to non-HCEs relative to HCEs. In other words, without non-HCEs participating in the plan and/or receiving employer contributions, HCEs may be limited or unable to make contributions. Safe Harbor rules provide an exemption to certain nondiscrimination tests that make it easier for HCEs to maximize employee deferrals.

WHAT ARE HCEs?

Any employee who:

- Receives at least $120,000 in compensation, regardless of ownership interest,

- Owns more than 5% of the company sponsoring the plan, regardless of compensation level, or

- Is a spouse, child, grandparent, or parent of someone who owns more than 5% of the company.

WHAT ARE THE BASICS OF SAFE HARBOR RULES?

Plan sponsors must provide a basic level of benefit to non-HCEs including either a 3% nonelective contribution or an up-to-4% company match. All Safe Harbor contributions are required to be 100% vested from the time of eligibility. Adopting Safe Harbor features decreases flexibility for plan changes and requires additional participant notices.

This is a broad overview of ERISA plan regulations. Contact the specialists with Physicians 401k so we can collaborate with you to provide the appropriate plan design to meet your goals.